top of page

Taxation

Oct 30, 20252 min read

Oct 21, 20252 min read

Jun 28, 20254 min read

Jun 10, 20252 min read

Jun 6, 20251 min read

Jun 6, 20253 min read

Feb 28, 20252 min read

Dec 4, 20241 min read

Nov 6, 20241 min read

Sep 12, 20242 min read

Aug 22, 20242 min read

Jul 31, 20242 min read

Jul 3, 20241 min read

Jul 3, 20241 min read

Mar 9, 20243 min read

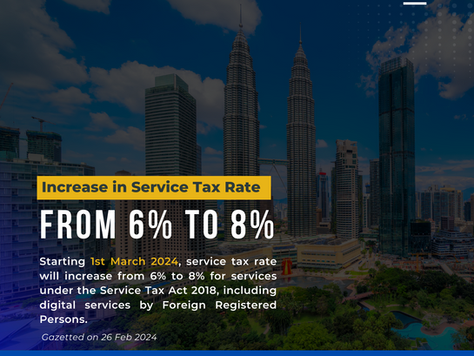

Feb 27, 20242 min read

Jan 16, 20243 min read

Nov 30, 20233 min read

bottom of page